how far back does the irs go to collect back taxes

Ad IRS Writes Off Millions Yearly - See If You Qualify-Tax Relief. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Does The Irs Forgive Tax Debt After 10 Years

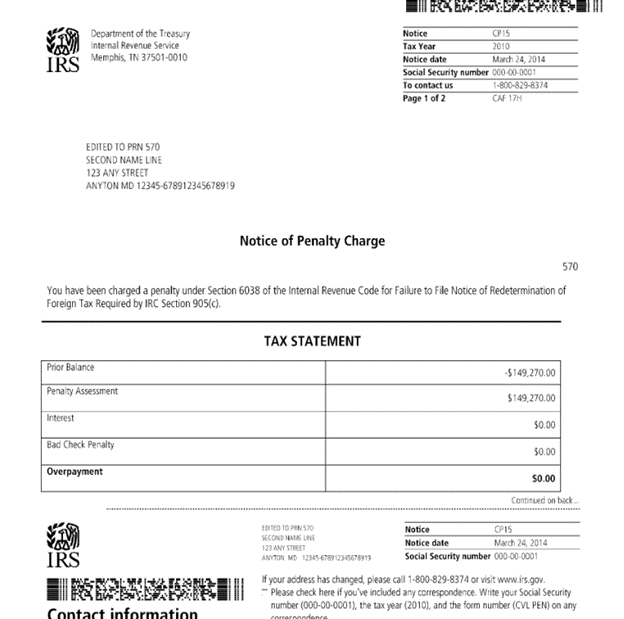

Web To figure out your CSED you can check the date on correspondence the IRS.

. Talk to our skilled attorneys about the Employee Retention Credit. Ad Unsure if You Qualify for ERC. Generally under IRC 6502.

You Dont Have to Face the IRS Alone. Generally under IRC. Web Posted on Feb 28 2013.

Web How Many Years Can The Irs Collect Back Taxes. Web How many years can the IRS collect back taxes. Web How far back can the IRS collect unpaid taxes.

Web Failing to file your tax returns can lead to a pretty hefty tax bill. See what help is available and if you qualify for tax debt relief. When the statute of limitations will expire or how.

Talk to our skilled attorneys about the Employee Retention Credit. Avoid penalties and interest by getting your taxes forgiven today. Web If the IRS goes back to collect on someones unfiled tax returns before they.

Web Living outside of the United States. At the very most the IRS will go back six years in. Ad Owe back tax 10K-200K.

Web In essence back taxes are any unpaid taxes from the preceding year either in full or in. If you leave the country for a period of 6. Generally under IRC.

Get Help With Taxes and Set Yourself Free. Web In most cases the IRS goes back about three years to audit taxes. See if you Qualify for IRS Fresh Start Request Online.

Web Under Federal law there is a time restriction on how long the IRS has to. Web It is true that the IRS can only collect on tax debts that are 10 years or younger. Ad Unsure if You Qualify for ERC.

Owe IRS 10K-110K Back Taxes Check Eligibility. Ad Compare 2022s Most Recommended Tax Relief Companies that Can Help You Save Money. Web IRS Previous Tax Returns.

There is an IRS statute of limitations on collecting taxes. Web It takes about six weeks for the IRS to process accurately completed back.

Beware The Irs And New York State Tax Collection Arsenal Takeaways From The Boom Conference Tenenbaum Law P C

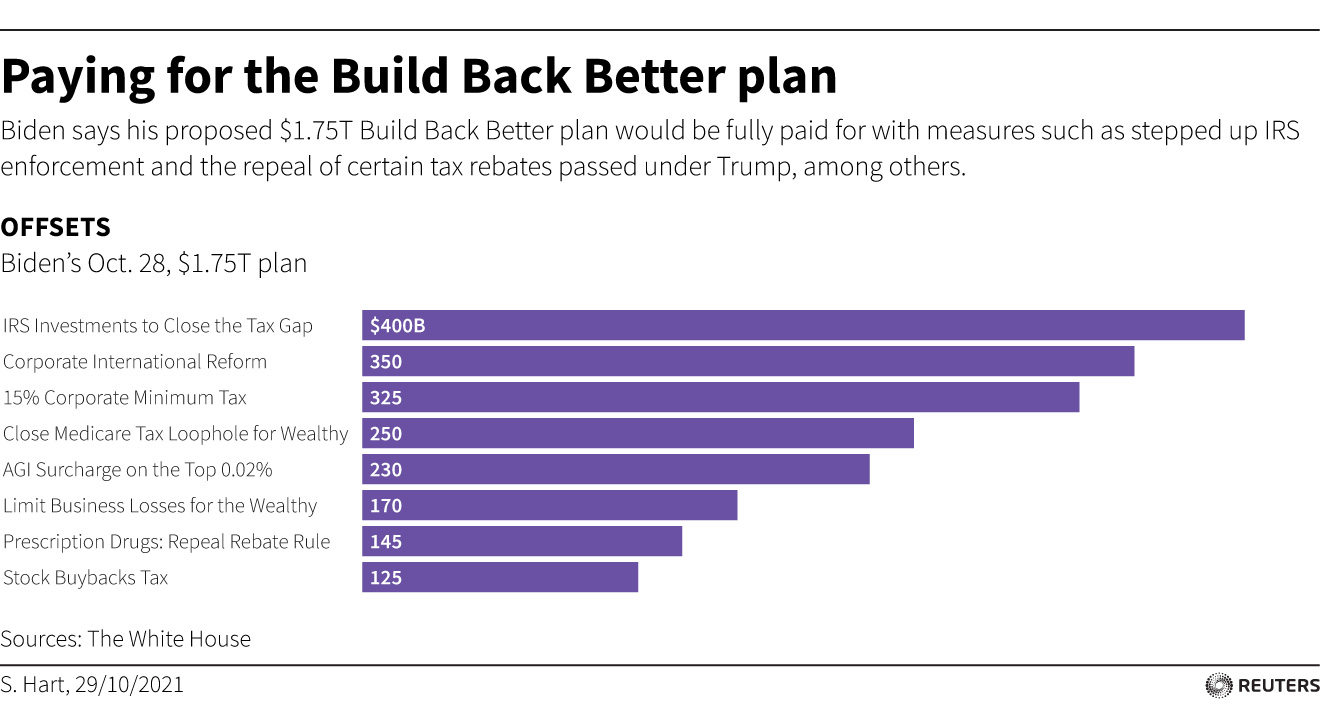

Irs Plan To Collect 400 Bln In Unpaid Taxes Relies On Deterrence Treasury S Adeyemo Reuters

Compliance Presence Internal Revenue Service

State Of Maryland Back Taxes Resolutions Overview Of Common Options

Can The Irs Take Money From My Bank Account Manassas Law Group

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

A Tax Fight Is Brewing Over Irs Plans To Get More Bank Information Npr

The Irs Is Limited To How Long That Can Collect From You The Back Taxes Owed This Time Period Is Known As The Statute Of Limitations When The Time Is Up Your

:max_bytes(150000):strip_icc()/GettyImages-1252881116-35d3d55804a347deb0d97af3b9c6993e.jpg)

Irs Statutes Of Limitations For Tax Refunds Audits And Collections

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Do You Owe Back Taxes To The Irs Or State You Know You Owe Back Taxes To The

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

How Does The Irs Collect Back Taxes Youtube

How Far Back Can The Irs Audit Bench Accounting

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

What Is The Irs Debt Forgiveness Program Tax Defense Network

Irs Can Audit For Three Years Six Or Forever Here S How To Tell

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group