when will capital gains tax rate increase

The proposal would increase the maximum stated capital gain rate from 20 to 25. FAQ on capital gains outlook and effective date.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Long-term Capital Gains Tax Rates for 2021.

. The effective date for this increase would be September 13 2021. 22 2021 at 1256 pm. With average state taxes and a 38 federal surtax the.

There is currently a bill that if passed would increase the capital gains tax in. Currently the capital gains rate is 20 for. Hawaiis capital gains tax rate is 725.

SEE MORE Tax Changes and Key Amounts for the 2021 Tax Year However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable. 2021 Long-Term Capital Gains Tax Rates. To fund the BBB original drafts included widespread tax increases on individuals and corporations including an increase in the capital gains rate for transactions occurring.

Lily Batchelder and David Kamin using JCT projections estimate that taxing accrued gains at death and raising the capital gains tax rate to 28 percent would bring in 290. The rates do not stop there. Additionally a section 1250 gain the portion of a gain.

The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in 2022.

For single tax filers you can benefit from the zero percent. Rate Single Married Filing Jointly Married Filing Separately Head of Household 0 0 40400 0 80800 0 40400 0. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

Tax filing status 0 rate 15 rate 20 rate. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. Ad Compare Your 2022 Tax Bracket vs. Discover Helpful Information and Resources on Taxes From AARP.

While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation.

Your 2021 Tax Bracket to See Whats Been Adjusted. The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate on long-term capital gains in the past 100 years and the largest increase in the. Understanding Capital Gains and the Biden Tax Plan.

That applies to both long- and short-term capital gains. Since your ordinary income tax bracket is 22 by taking advantage of the lower capital gains tax rates you saved 70 in taxes 150 versus 220 on a 1000 capital gain. But the truth is raising the capital gains tax rate wont hurt the economy or cut investments at all.

Capital gains tax rates on most assets held for a year or. Above that income level the rate jumps to 20 percent. In fact Bidens plan to raise the capital gains rate that wealthy Americans.

Dramatic increase in IRS capital-gains transactions as Biden administration considers raising tax rates on the wealthy Last Updated. Taxable income of up to 40400. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

When Does Capital Gains Tax Apply Taxact Blog

Capital Gains Tax Calculator For Relative Value Investing

How To Save Capital Gain Tax On Sale Of Residential Property

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Tax Breaks For Capital Improvements On Your Home Houselogic

Selling Stock How Capital Gains Are Taxed The Motley Fool

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Yield Cgy Formula Calculation Example And Guide

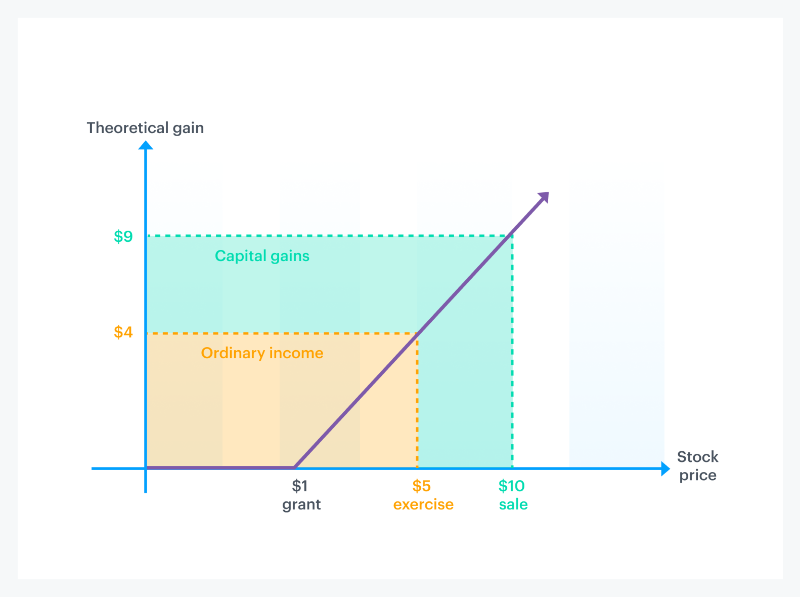

How Stock Options Are Taxed Carta

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)